Prepare for long-term goals during good times

Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

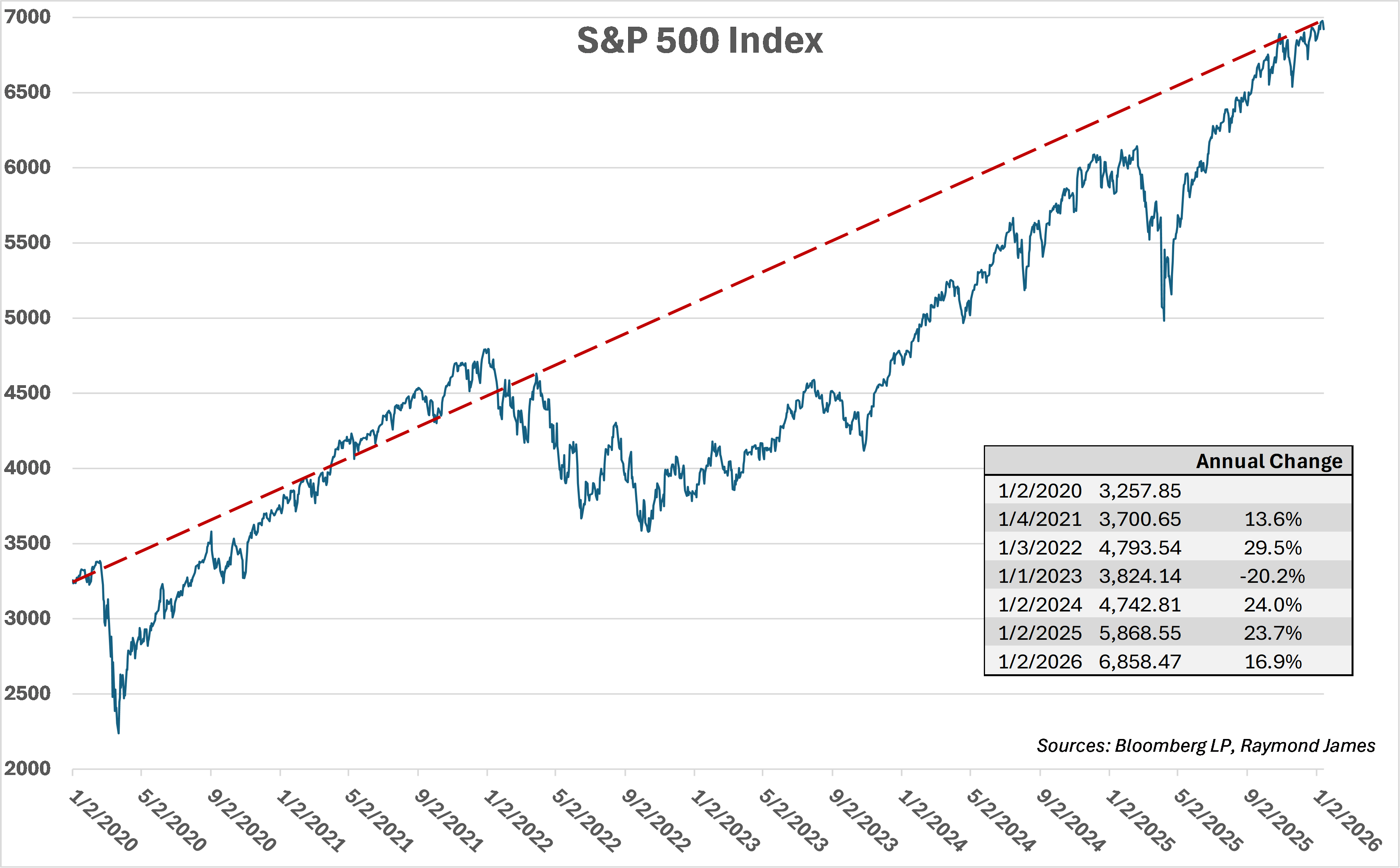

Investors have reaped the benefits of good market conditions in many of the recent years. These periods are ideal for wealth accumulation. The S&P 500 Index has provided double-digit returns in six of the previous seven years. Home prices monitored by Case-Shiller, the single largest investment for many investors, peaked in June 2025, adding to individuals' net worth. The US Average Hourly Earnings, according to the Bureau of Labor Statistics, averaged a gain of 3.8% in 2025, above the average of 3.1% since 2007. The bottom line is that, in general, it has been a pretty good ride, and wealth has increased for many individuals.

This is a time when investor vigilance should refocus attention on long-term goals and strategies for investment portfolios. For many investors, this is achieving a comfortable income and cash flow to be utilized during retirement. Having excess wealth is exciting and welcome but taking risks that jeopardize the primary goal can alter retirement timelines or prevent the lifestyle we desire altogether. Investing can get emotional, and when it feels good, it is easy to take unnecessary risks. The positive trend can seem like a given. Graphs of two timelines tell the story:

The recent historical trend of the stock market makes for a compelling “all in” strategy. As noted, six of the last seven years produced double-digit returns. A natural anchor bias can sway strategic decisions and lead to an unbalanced portfolio that assumes more risk than your long-term plan warrants.

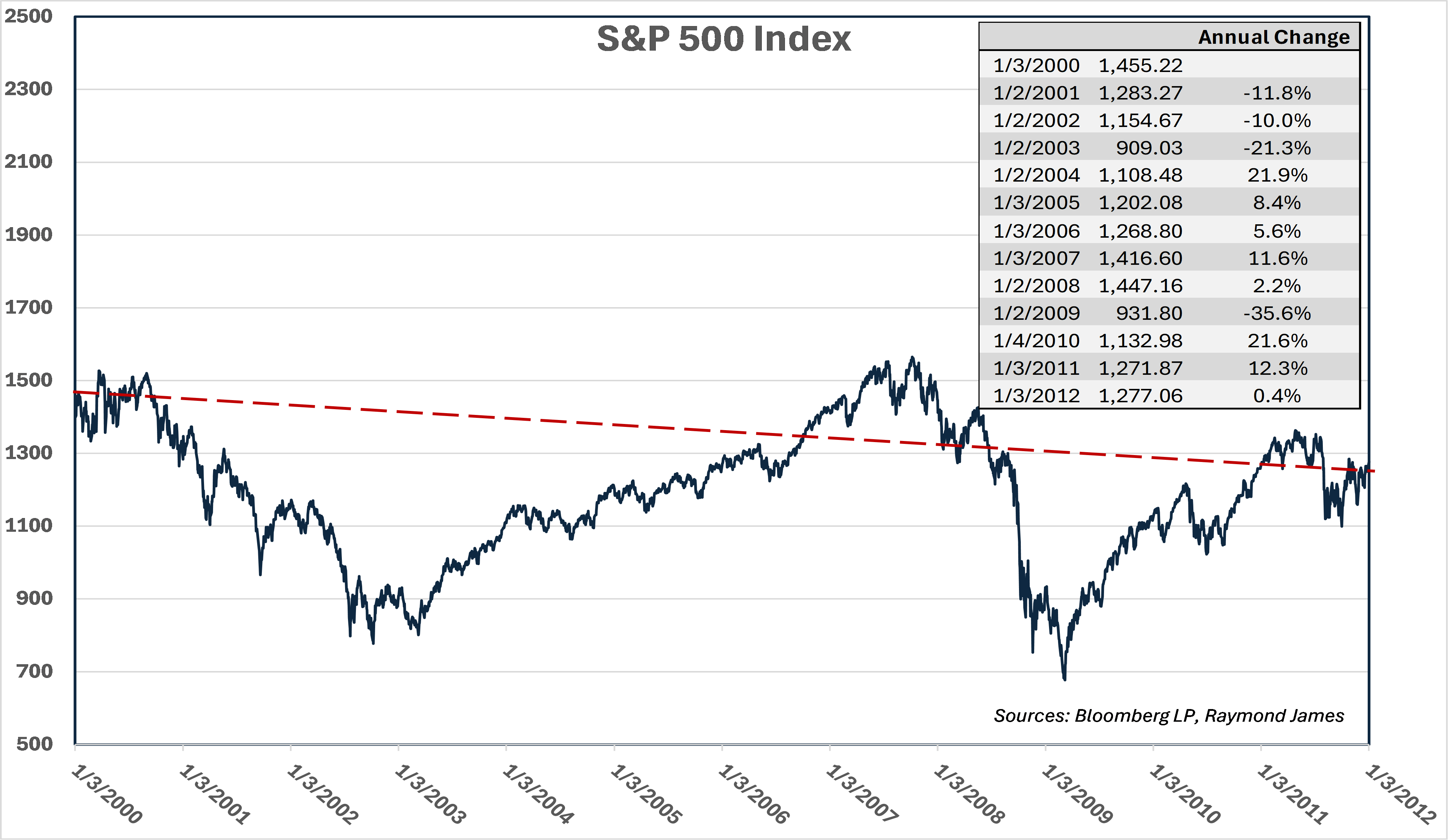

Unfortunately, markets are not that predictable. The following graph depicts over a decade (2000 to 2012) of stock underperformance. History is not an indicator of the future, and I am certainly not suggesting that the markets are headed in any particular direction. I do, however, want investors to be grounded in their decision-making. The S&P 500 trended down during this period. You’ve probably heard variations of this saying, but the time to prepare for bad times is during the good times.

Stay balanced. Take some of the wealth accumulated over the last many years and rebalance to your appropriate allocations of growth (stock) and wealth preservation (individual bonds). This is particularly warranted for investors at or approaching retirement age. The goal is to secure an adequate income and cash flow to take you through retirement. If you are there, what better time to lock it in? Over the last three years, interest rates have been elevated, helping not only preserve wealth but also deliver high income levels.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.